In this webinar, which you can view here, Manish Pandey tells us about the transformative effect real-time data, machine learning, and artificial intelligence will make in helping financial services institutions meet increasing demands from consumers. (You can also see the slides.) Pandey, who is Sr. Director of Business Development and Digital Strategy at SingleStore partner Fiserv, highlights the power of SingleStore, and the smarts that Fiserv can bring to helping companies make the most out if it. – Editor

As you know, financial services has always been an exciting world. And to add to it, it’s an interesting time as well for several different reasons. Data analytics and the speed at which we access, analyze and make sense of data, has become such a critical part of our business today.

It’s not that data and speed were not important in the past, but the game is different today because our consumers understand what it means to have a profound experience. In fact, just to share a couple of data points to set the context, in a recent article by The Financial Brand, they talked about four D’s of consumer attrition, four D’s of consumer attrition are dissatisfaction, debt, displacement and divorce.

Actually, no prizes for guessing, but more than 50% of consumers leave their bank because of dissatisfaction. Dissatisfaction has several different aspects of it, but the key part is attrition. The consumers are leaving the bank because they are not happy.

According to a recent survey from TD Bank, the risk of payment fraud is the number one concern for 44% of financial industry professionals this year. That’s a 14% increase in just 12 months.

So, on one hand we have consumers who are demanding the seamless, real-time experience. On the other hand, we have to deal with all these threats, which means friction. How do we balance it? I will touch upon three aspects of our world and discuss why it’s important to have real-time data computing capability. Also, why leverage analytics, machine learning, AI in combination to drive business forward and create delighted consumers.

Digital-Native Companies are Setting the Pace

With that, there are many reasons why these two are so successful, but one common aspect, they both know their customers very well. Also, they know how to engage with them without having a customer care person talk to them. In fact, I don’t know about you guys, but in fact, for me in last several, several years of my experience with these guys, I’ve never had to call them for any issues, which is just profound customer experience that I talked earlier on when we were setting the topic.

How they do it, they know their customers like no one does. It’s not rocket science but, as I like to call it, it’s data science. They know how to use the data, not just data, but how to use the data in real-time and make sense of the data. Use the data to monetize as well.

Look at what Google or Uber or Facebook are doing with that. They are pivoting to several related services and offerings and expanding their business, because of the way they use the data. Can we say the same thing for financial institutions? I have my different opinion on that.

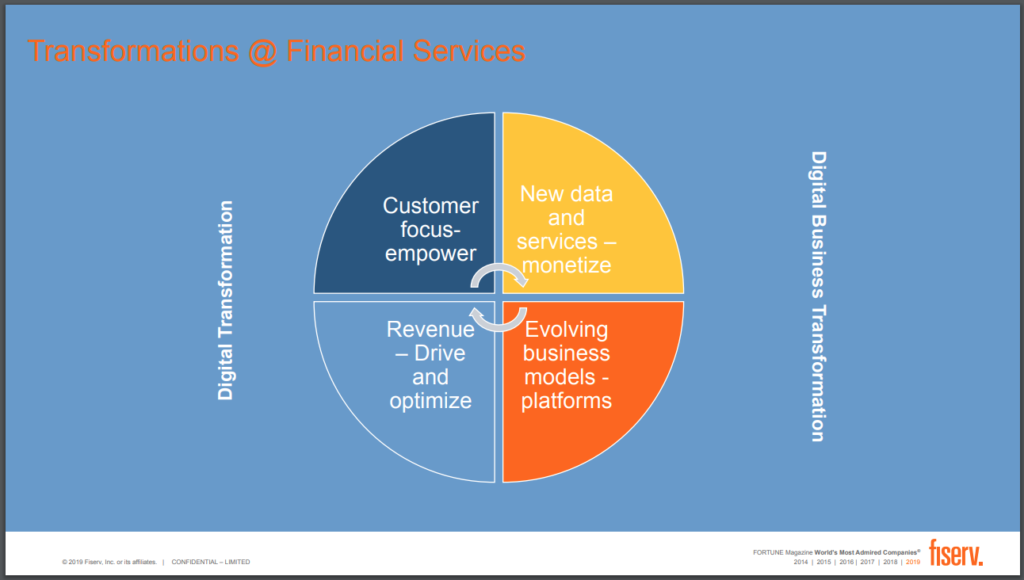

These innovations have changed the game in the industry. What’s happening close to our home in the financial services? If you look at financial services, I end up talking to four or five financial services companies, with the banks or insurance companies or credit unions, in a week. And it’s tons of engagement on so many different conversations and topics, but one of the key aspect that’s coming up pretty much in every conversation that either these financial institutions are trying to become a digital business or are going through a digital transformation, or they’re looking at digital business transformation.

When we talk about digital transformation, it simply means that they’re trying to empower their customers. They’re empowering their customers on all different channels. It doesn’t matter how they are interacting with the banks, whether they are going online using tablet or mobile or simple desktop or they are calling a customer care rep and talking, or they’re walking to the branch.

It’s about helping your customers do a lot of things themselves and that gives them freedom to express themselves. At the same time, with this transformation, FIs are trying to drive revenue and optimize the revenue either by selling new products and services in that space or driving the wallet share. When you think about the business transformation, there’s a lot happening in financial services.

At the same time, when no one thought that any innovation is possible in insurance, companies like Lemonade came with a very little investment and funding, and they are threatening bigger insurance giants because of the simple user experience they have created for their consumers, and the way they have reduced the processing time using technologies like machine learning and artificial intelligence.

They are bringing the innovation coming from non-banking industry and threatening our banking industry and financial services companies because, simply they have been able to help the customers, empower the customers and change the business models. It’s the time that, when we are seeing these conversations that are happening in banking and financial services too, when banks are looking to become platform companies. When there are talks around banking as a service being offered to non-banking companies.

Consumer Demands are Changing

There are discussions around Apple working with Goldman Sachs and talking about new cards in the market. With that, I want to shift our focus on the consumer side. So far we’ve talked about what’s happening at the more organization level in the financial services industry, but now if you look closely on the customer side, customers are telling us every day, they are giving us feedback.

The reason we need to understand what they are giving us as a feedback is because we got understand what’s shifting in that paradigm. I mean, there’s a lot of noise, at the same time, there’s a lot of good feedback coming from our interaction with consumers. That’s the reason we need to understand the data. We need to access the data in real time and deliver the technologies that we talked about, analytics, machine learning, and AI, and it has gained much significance now.

Consumers today have all different kinds of experiences in retail, online and entertainment. They want to do what they want to, and they want to do it now. I will say this one more time, they want to do what they want to do, and they want to do it now. We can’t disagree with that because, we are a consumer, and we also see that we are getting different experiences when we interact with the different touch-points.

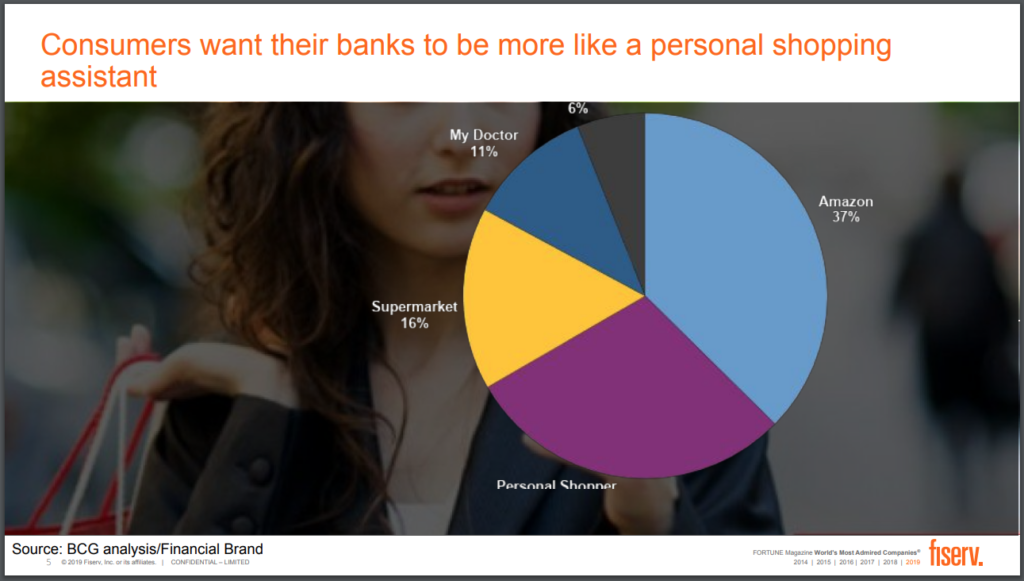

What you see on the screen is a representation of the same. They no longer see banks they used to see earlier. They’re demanding experiences consistent with what they see with other touch points. Consumers are saying, “Know me. You have all the data.” No one has more consumer data, in my opinion, than banks. We have all kinds of consumer data. They spend most of their time with us, and they spend most of their emotional relations with us. Money is not just money anymore. Money is very much emotional.

So what do we do with that data? What do we do with that information? I’ll give you two real-life experiences. Banks who I deal with, if they are careful, they will understand that I’m not a phone-banking guy. I’m not a snail mail kind of guy. I’m more like an online guy. I love to chat with my bank. I love to interact with the chatbots and clarify my questions, but I see those banks interacting with me, sending those offers in my mailbox every week. Tons and tons of paper. I have no clue why they do it.

Clearly, it means they don’t understand me. They don’t understand my preferences. Another example, one of the leading banks in this country, I went to them four, five years back. I just wanted to explore options of refinancing, because I thought I will take benefit of some lower interest rates. They were nice enough to run an analysis on me and look at my interest rate. They came back and said that, no, I have a very good deal, and I should not look at refinancing. It won’t be cost effective for me, and I listened to that.

Now, from the same bank, I started getting mailers on refinancing. One, they are sending those mailers in my mailbox, again, every day. And now they advised me not to go for refinance, and they’re asking me to refinance, and they are sending me offers on refinancing. That’s so ridiculous. I mean, I’ve no idea why they will do this to me, or any consumer. That clearly tells us that we are doing not much with the data, or we are not doing much with the information that’s coming from the consumers.

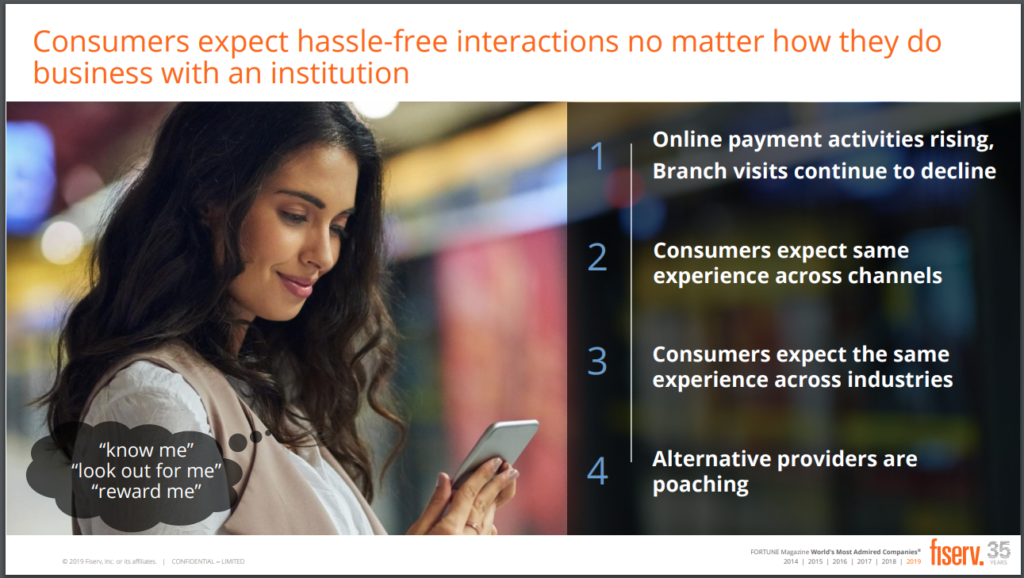

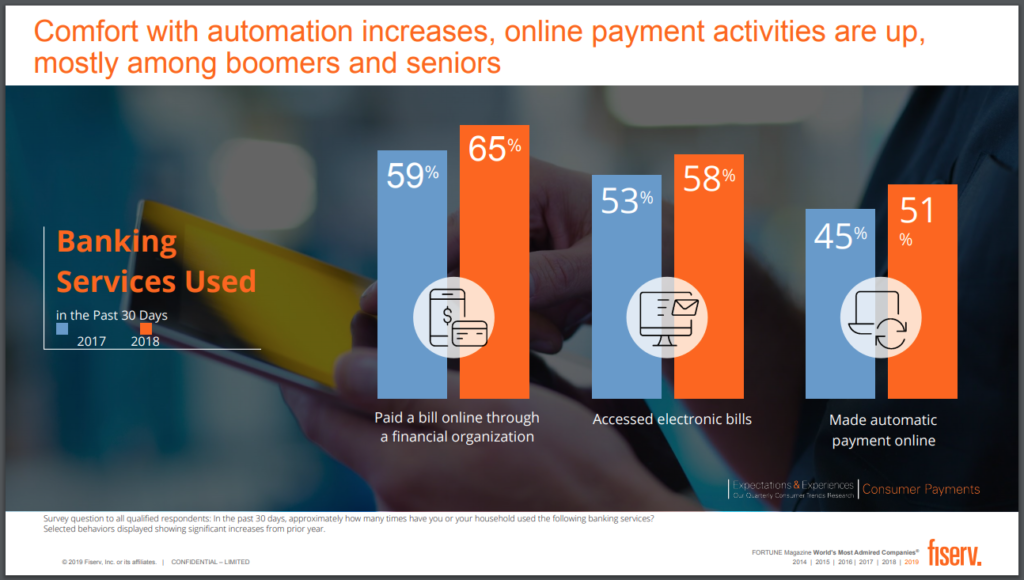

That’s been the biggest difference that we are seeing in our industry as compared to some other industries. If we go further and if we talk a little bit more about consumer expectations, so consumers, obviously, are expecting hassle-free interactions no matter how they do business with any institution. To give you some data points, these consumers are becoming increasingly comfortable with different ways to do any transaction, for that matter, paying as well.

Whether it’s the older generation embracing digital channels or more people saying they see a digital wallet as secure. It is clear consumer perceptions are evolving. Several types of online transactions are showing modest increase over last years, including banking and financial transactions. We are also seeing boomers and seniors often showing largest increase and, though they are still trailing behind the other generations, but they are spending a lot of time online.

And they are doing a lot of transactions online, whether they are doing financial transactions, or they’re doing non-financial transactions, or they are on social media. Those experiences are different for them and, obviously, that’s why there is a conversation as to why I’m not getting a consistent experience. Although many consumers also remain at least somewhat concerned about the security of receiving or paying or doing financial transactions, but they are embracing the new technology and experiences more and more every passing year.

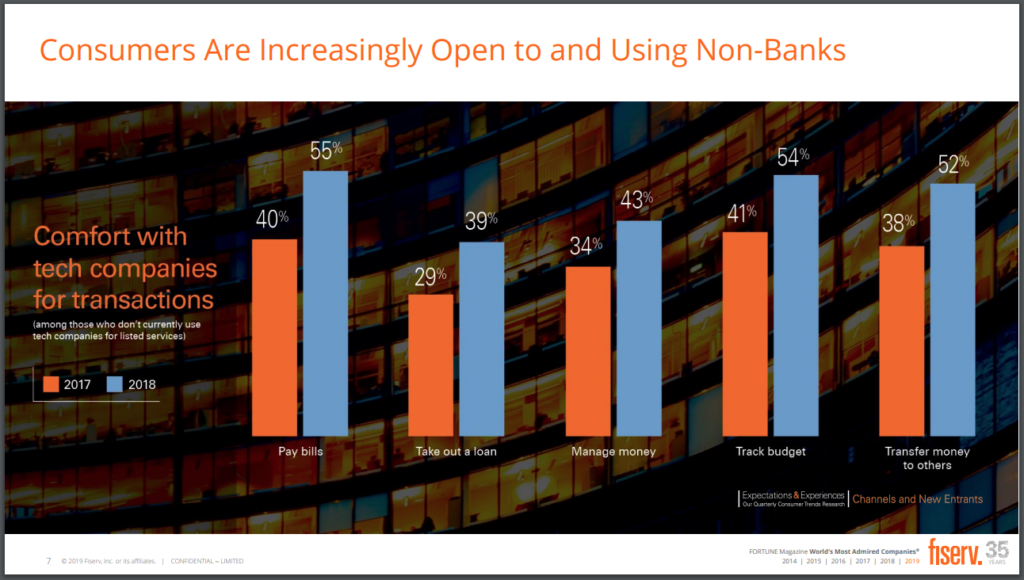

With that, we also look at, consumers are also increasingly getting very open to using non-banking companies, which is extremely important as you as a consumer. I mean, and your consumers you see that, when they are becoming more comfortable with non-banking players, especially when it comes to paying bails or taking a loan or managing money, tracking your budget, transferring money or anything, something financial, it’s not a good sign. It’s not a good sign because, we always thought that consumers will be attached with the banks because of several different reasons but, now because of experiences that they are getting from non-banking companies in these areas, they are all ready to switch.

Just to let you know a data point, in 2017, 40% of consumers stated that they would be comfortable using a technology company to pay bills compared to 55% of them in 2018 survey, which is a big jump. So, today, consumers demand convenience, ease of use, faster services an enhanced user experience and interface.

Not to spend too much time on this one, but we are also seeing, comfort is increasing with automation and online activities are increasing day by day. Not just among the younger generation, but baby boomers and seniors are getting very comfortable as well, and that’s the point that we are trying to convey.

So, it’s cutting across different generations now. It’s cutting across different customer segments. It’s cutting across within the segments as well. As we go along, we’ll talk about how a bank, in fact, not just their data customer segmentation, but they developed like 15,000 micro customer segments depending on several different parameters. Now we are seeing the trend happening across different segments and within those segments and it’s just mind-blowing.

How Financial Services Companies are Responding

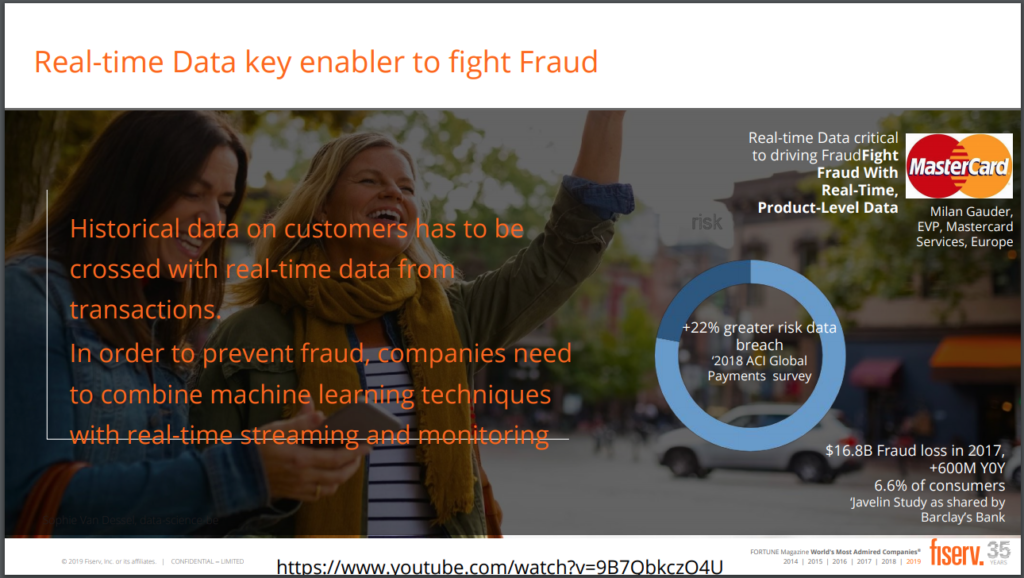

Now we are moving to the third dimension. I mentioned in the beginning of the webinar that I will touch upon three different dimensions of our world in this context in terms of access to real-time data and analytics and machine learning. We talked about what’s happening at the broader financial institution level. We talked about consumer preferences. Now, we’re going into the risk and fraud area. The risk and fraud has gained a lot of attention. It’s always been a very sticky topic, but now with the exposure that we have, with the technology, I mean, we are also seeing those cases of fraud increasing year on year.

And there are millions and billions of dollars lost. It’s not just the amount of money lost, at the same time we’re talking about its impact on your brand and consumers. That’s the key reason that we should be looking at real-time data computing and combining this with analytics and other technologies that we’ve been talking about and not just detecting fraud but preventing fraud. That’s going to help us not just in terms of cutting our losses but, at the same time, it’s going to help us from the customer satisfaction point of view also. (See the YouTube video about PayPal and how they accomplish these goals.)

Because, while the customers are talking about a seamless experience, they are not going to compromise on their data and security of data. So, it’s a balancing act that we have to play and in that context we have to make sure that we are preventing the fraud using real-time analytics and the power of real-time data computing. That’s not a surprise, that several senior executives in the financial services are using AI technologies in various areas such as personalization, in terms of how they deal with consumers, or how they think about their relationship with consumers.

Productivity, fraud, wealth management, advisory services, and the list is ever growing. Where are you using this? That’s a question that we should be asking ourselves when we are looking at our strategy in terms of how we are looking to do our business. Why this is so all complex. Why this needs various areas of strategic focus rather than a siloed approach. Well, to start with, there are several challenges of legacy data, but it’s too big, too disparate, and too slow.

Just to give you some data points. 3.5 billion Google searches are conducted, 300 million photos are uploaded to Facebook, and 2.5 quintillion bytes of data are created. IDC predicts global data will grow tenfold between 2016 and 2025 to a whooping 163 zettabytes. I don’t even know how to spell this, and I don’t even know how many zeros there are in zettabytes. It’s just a mind-blowing number.

I mean, it’s just mind-blowing when we talk to banks, and when I hear the stories, they don’t even know where all the data is sitting and how old the data is. They are living with the data, which, probably, they never want to use it.

In terms of velocity, data needs to move faster than legacy systems can handle. Even a 10-seconds lag in data delivery can pose a threat if you are dealing with, say, hyper-critical data. Again, IDC estimates 10% of all data will be hyper-critical in nature by 2025, so we are dealing with, not just the data, huge volume of data, at the same time, we are dealing with very sensitive data. So, why haven’t we moved faster and why now? Great question. Well, we have not moved faster because several different reasons, we talked earlier on and in the last slide as well.

A strong data infrastructure and capability is really, really needed, which can help you solve real-time use cases. That will allow you to predict, optimize and forecast. It could also help you stream data from multiple legacy systems or sources and that’s where we are talking about how a more strategic approach to data capability, and not a siloed approach, can help you. At the same time, we’re talking about a much more robust data infrastructure and that’s where we were looking about this whole in-memory data computing, and SingleStore is playing a much bigger role with dealing with clients like you.

The challenges are part of our business and there are many, and the way we have evolved the challenges have compounded. Then, of course, there is always, always pressure on total cost of ownership. There is always pressure on our bottom line. So, we have to move because of these reasons, and many other reasons that we have talked about. I think it’s fair to conclude here on touching upon those three areas and concluding with this quote that only things advancing faster than technology is consumer expectations. The fact is, the pace of change is accelerating. Your customers and consumers want what they want and when they want it. The name of the game is speed, ease and convenience.

How Fiserv and SingleStore Help

Real-time data for sure moves your business forward. Now, just to talk about some of those success stories that we have seen, not just working with our clients but, I also looked at some broader audience. I want to talk about just a few of them and then we will talk about what Fiserv and SingleStore are doing in this space and then we will take up some questions. The first one that you are seeing on the personalization, this was a story of a U.S. bank, which used machine learning to a study that discounts its private bankers were offering to customers.

The private bankers claim that they offered these discounts to very important, valuable customers, but the analysis showed a different outcome. So the bank used analytics to determine that who should be given those offers. And they made a campaign around a personalized offering based on analytics and real-time processing of the data on the consumers. They saw an 8% increase in the revenue in just a few months, so that was a very profound ROI that we noticed in terms of driving your revenue using the power of real-time data and making a personalized offer using analytics and related technologies.

When we talk about the next use case here, this was a story of a European Bank. They tried a number of things to forecast consumer attrition. Many of those, they did not give them the desired outcomes, so they turned to machine learning, and they build a predictive algorithm on customers who were still active, but they were likely to reduce their business with the bank. The new understanding gave them rise to a targeted campaign that reduced churn by 15%, which was, again, a very significant result that they noticed using machine learning and analytics technology.

Then, the last one that I have, it’s an example of a bank in Asia, a leading bank. It used advanced analytics with the data streaming from so many different systems. Some of them, data points, were coming … like customer demographics or key characteristics of the customers, the product held, the credit card statements, the transactions and the point-of-sale data, online and mobile transfers and payments and credit bureau data. And they looked at completely 360-degree profile of the customers, and the bank discovered that they were not just looking at four or five or 10 different customer segments, but they were looking at like 15,000 micro-customer segments.

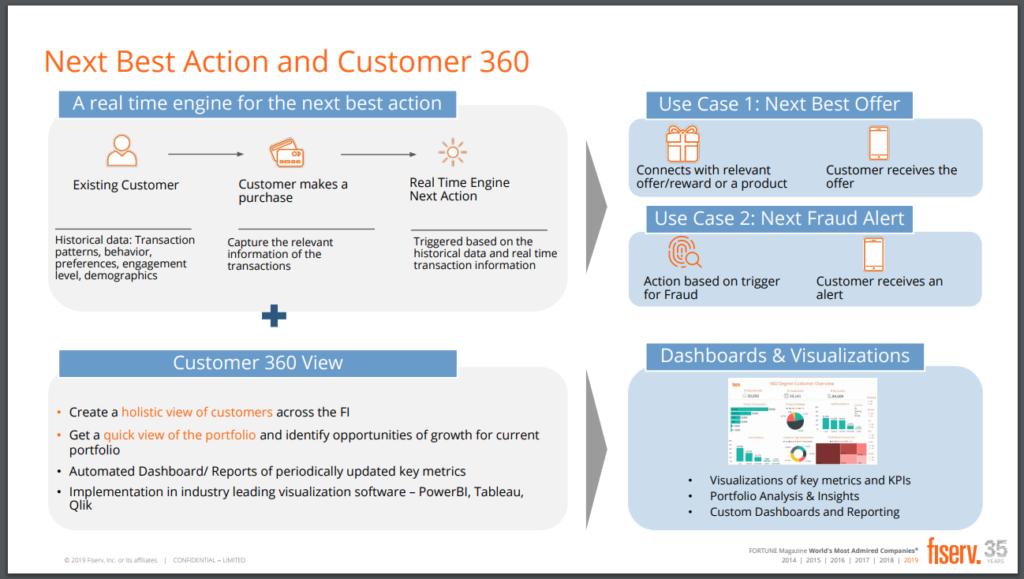

That helped them build a mixed product to-buy model that increased the likelihood to buy three times over. That was a really profound learning for them and that helped them grow their business significantly. What Fiserv is doing, in collaboration with SingleStore, is also working with its clients on several different use cases, very, very similar to what we talked in the last slide. Some of them are listed here, but that’s not all, but we are also looking at how we can help our clients understand their consumers looking at their structured data, unstructured data and the social media data.

Basically, ingesting data using SingleStore technology and then using the power of Fiserv data analytics and developing a complete customer crisis degree profiling and making a determination on how to engage with those customers. And that leads to the next best offer or next best action that we can take with those consumers. I mean, they could be attrition candidates, they may be dissatisfied, they may be a good candidate for causes opportunity.

They may be moving, or they may be buying a new house, and we should be always there in front of them, going back to our team that we should know them, because our customers are expecting us to know them. At the same time, we got to also look at fraud alerts. That’s where we have combined together, and we are working on the power of real-time data and analytics to make sure that we are putting use cases which can help us predict or alert, fraud possibilities. Not to discount the point that we have also developed various dashboards and related portals, which can help you aggregate data in real-time and make some significant determinations as you go on.

With that, I’m going to sum it up, and I’m going to say that, now, if you are interested in learning how the combination of real-time data computing offered by SingleStore and Fiserv’s power of analytics can help you grow your business or drive customer delight by offering real-time personalized services offers. Or, simply, identifying real-time data-related use cases suitable to your needs. We are very, very happy to talk one-on-one, and we are always willing to learn and share. So, reach out to my colleague, Lois, or myself, and we will set up some time and learn from your experiences and share ours.

Questions and Answers

Q. You talk with customers every day. What have you seen as the biggest changes in terms of market dynamics or priorities?

I will answer this from two perspectives, one from the consumer point of view and one from the financial institutions’ perspective. When we look at the consumer, we talked about that. I mean, consumers are, of course, expecting a seamless experience when they are dealing with Netflix, Amazon, and the other touch points. They expect us to provide a similar experience when they deal with their banks.

At the same time, they are being very loud and clear and they are saying that, “Hey, you’ve got to know me.” When I was engaged in one of the conversation with customers who were saying that, “Hey, when I’m filling a form on Facebook or other non-banking financial portals, I generally see that they fetch data from other sources about me.” And, hopefully, some data or type-ahead kind of thing. It’s happening in our world too, which is very profound. It goes back to the point that knowing them is really important.

At the same time, they’re saying that, “Know me now.” So the real-time has a huge significance. There is no real opportunity for us to have any lag when we deal with our customers. So that’s from the customer point of view, but from the financial services’ perspective, I mean, the average span of human attention is five to seven seconds, which is less than a goldfish attention span. So if you’re talking about that kind of limited opportunity for us to engage with our consumers, and since they’re interacting mostly with digital channels, we have to be pretty solid in terms of how we are communicating with them and how we are not losing them in those five to seven seconds.

That’s the kind of significant change that we are seeing and it goes back to one of the things that I mentioned that, how do you make your offers or interactions personalized and not make it generic? Not make it broader group-wise interaction? And there is a pattern evolving around these needs that we need to understand if you have to interact with those customers better and get their attention. So that’s the kind of changes I’m seeing right now from both perspective.

Q. How should we start the journey if we want to move towards real-time data computing and analytics?

Sometimes, it’s overwhelming because just the kind of challenges our ecosystem presents to us. We talked about legacy data and data sitting in silos. Data always been, again, it’s my personal opinion, data always has been one of the low-priority items in the financial services industry. Not that we didn’t value data, just that the challenges were so big that we never put so much attention on that.

However, because of the changing dynamics, it has changed a lot. Now, my suggestion in that context always been to my clients that, let’s not try to solve so many use cases at one shot. You need to pick up a use case which is aligned with your strategic priority, whether it’s the use case around consumer or fraud or just accessing the data for various internal consumptions, which can help executives make better decisions.

So it could be any of those areas, which are aligned with your key goals but, at the same time, the data strategy has to be much broader. And the infrastructure that you are looking at should be thought of from the perspective that you’re going to scale up and address many use cases. So start with one use case, but think about a much bigger data infrastructure game plan and a much better strategic analytics strategy and that’s where you can handle one use case, show the value proposition, show the ROI to your leadership team and then move on to the next one, but at the same time you have the infrastructure ready for that.

Q. Can Fiserv and SingleStore help us understand our current landscape and help solve some use cases?

Absolutely. That’s one of the reasons we’re partnered together because we want to provide end-to-end services and solutions to our clients across the entire journey. Fiserv and SingleStore can really look at, from the very beginning of your journey and walk the entire path. When I say that, what I mean that we can come and look at your current state of your data, data infrastructure, what kind of business priorities you have.

And then, from there on, we can really build a strategy for you and then we can execute them back together. That’s what I mean by walking the path together. Fiserv and SingleStore, very, very happy to engage with you guys wherever you are in your journey. Not just solve use cases, but we can help you identify the right use cases, align with your business priorities and solve them for you.

The biggest roadblock is to getting projects to move forward or to reinvigorate stalled opportunities. How have your customers and partners overcome these roadblocks?

The biggest one always being around, like I was sharing, it’s about data access. It’s been, because the way this industry has evolved, there are so many legacy systems. Those systems, probably, were not required to talk to each other in earlier days. We are required to look at data the way we need to look at data because of the experience consumers are getting outside banking and financial services world. It has forced all of us.

So, that’s been the biggest challenge – how do we access data? How do we make sense of the data, and then, how do we monetize the data? Again, we are working with our clients to really navigate this path and not get really bogged down in this whole journey by putting the right strategy in place. At the same time, guiding them towards the right tools and technologies that should be leveraged to continue on this journey.

Again, the key point here is that, identifying the right use case. Whether it’s related to consumers or related to fraud and risk management or related to compliance or is related to helping your executive leadership make real-time decisions. It could be any of those areas, then we go backward and understand, how do we navigate through the data infrastructure, database challenges, how do we facilitate the realtime computing and then, at the same time, how do we enable you to address future use cases? So, I think the silos are the biggest opportunity here.

Conclusion

We invite you to learn more about SingleStore at singlestore.com or give us a try for free at singlestore.com/cloud-trial.