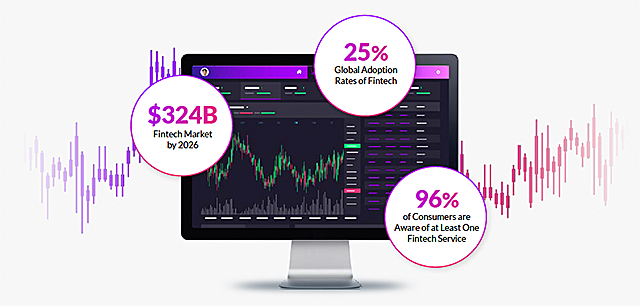

What do embedded finance, Banking-as-a-Service (BaaS), crypto trading and real-time trading and financial data marketplaces have in common? These very different applications, all powered by SingleStoreDB, are part of the rapidly growing Fintech sector, which is projected to grow to $324 Billion by 2026. Here’s a recap of our new Fintech eBook, “Powering Data-Driven Innovation in Fintech: Four Customer Examples.”

Every time you round up a purchase and put the spare change into Acorns, check your investment portfolio or execute a crypto trade, you’re using a financial application or technology (fintech), a sprawling category of new solutions that can be defined as:

[N]ew tech that seeks to improve and automate the delivery and use of financial services. At its core, fintech is utilized to help companies, business owners and consumers better manage their financial operations, processes and lives by utilizing specialized software and algorithms that are used on computers and, increasingly, smartphones.

Fintech is already huge, with a global adoption rate of 25%, and innovation is set to ignite even further; venture capital funding for U.S. fintechs doubled in 2021. In the U.K., Fintech investment soared seven-fold year-over-year in 2021, to $37.3 billion from $5.2 billion in 2020.

SingleStore delivers enabling technology

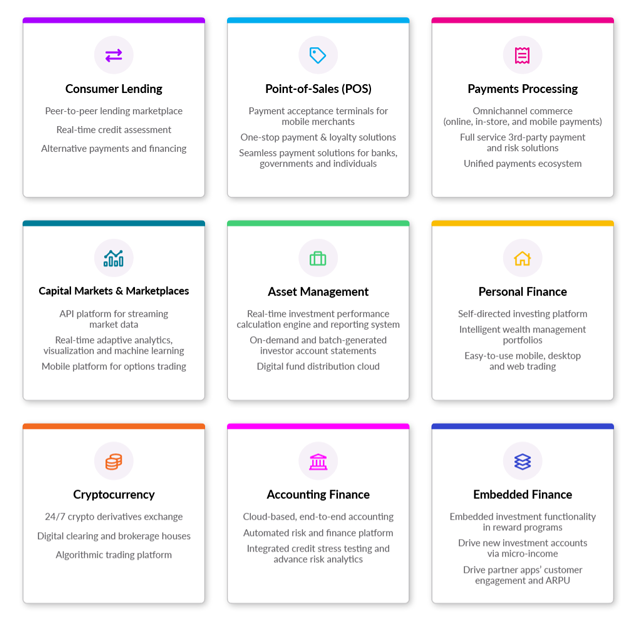

New opportunities and use cases demand new strategies. Today, SingleStoreDB powers over 100+ leading SaaS applications globally, enabling modern data-intensive applications for fintechs across multiple segments including:

- Real-time trading

- Personal finance

- Consumer lending and payments

- Capital markets

- Financial data marketplaces

- Cryptocurrency trading

Our new eBook, “Powering Data-Driven Innovation in Fintech: Four Customer Examples,” provides an overview of this dynamic space and highlights four customer examples that illustrate how top fintechs put SingleStoreDB at the heart of their fintech SaaS applications to deliver superior speed and customer experiences . Here we’ll share the highlights of one of those customer stories, AntMoney. Be sure to check out this eBook for IEX Cloud (real-time capital markets data marketplace), BitWyre (cryptocurrency derivatives exchange) and DailyVest (high-performance 401[k] reporting solutions),

Spotlight on Embedded Finance: AntMoney

Embedded finance enables non-financial institutions to offer customers financial tools or services, seamlessly integrating creative forms of payment, debit, credit, insurance or investment into their end user experiences. Founded by Acorns veterans and owned by ‘buy now pay later’ fintech Affirm, AntMoney is an embedded finance leader. It offers an embedded investment platform that allows companies to reward customer loyalty not with rebates or other non-monetary incentives, but by putting money into their very own investment account.

Blast, one of AntMoney’s apps powered by the company’s technology, features a Game-based Savings plan that allows users to transfer 1¢ per in-game action from their personal bank account to their Blast savings account, promoting gamers’ engagement with popular titles such as Fortnite, Overwatch and others. Blast will soon allow users to invest their accumulated savings through the app.

SingleStore speeds AntMoney

The success of Ant Money’s embedded finance solution has resulted in aggressive growth including 3X user growth, 5X increase in revenue, 1,200+ sponsors and partners and $20+ million in series A funding. However, this growth has led to technical challenges.

And, SingleStoreDB helps Fintech companies like AntMoney to easily scale their applications and deliver an interactive customer experience, high availability and speed.

Prior to SingleStoreDB, AntMoney Ant Money launched its platform with PostgreSQL on Amazon RDS for first-party data and Amazon Quicksight for analytics, as it was easy to prototype, ingest data, and perform basic reports with this configuration. However, this was a costly, fragile system not well-suited for the long term.

The system was slow, with queries taking seconds to minutes to process, and lacked coverage for emergent data sources such as ATM.com or financial services. The replicated data needed to be re-ingested, and the dashboard only refreshed once every 24 hours, leading to a serious and unacceptable lag in data freshness.

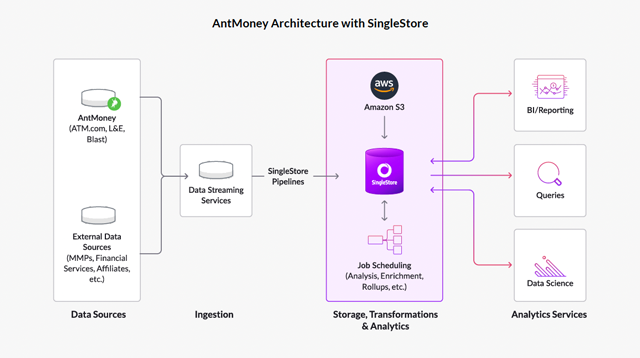

AntMoney replaced Postgres with SingleStoreDB, creating a new topology illustrated below.

SingleStoreDB: Built for Fintech

With SingleStoreDB, AntMoney was able to drive 60x improvement in data freshness and performance. Business teams were able to measure effectiveness of new features being rolled out immediately, instead of waiting 24 hours for their first data signal. The company saw a 50x increase in usable data to shape, slice and dice data for various user needs while driving user satisfaction.

Finally, AntMoney lowered overall TCO by 10x to boost performance and scale while keeping their engineering team lean, with less busywork (like writing ingest logic). This allowed the company to recoup valuable development resources that could be focused on other business priorities.

SingleStore powers modern applications in fintech

SingleStoreDB offers a next generation distributed database for powering all manner of data-intensive Fintech applications.

From modern data marketplaces to Banking-as-a-Service (BaaS) and embedded finance solutions, SingleStoreDB drives innovation with real-time analytics, scale, performance and lower TCO. AntMoney and all of the stories featured in our new Fintech eBook are made possible by leveraging SingleStore’s cloud-native, massively scalable architecture that provides fast ingest and query performance with high concurrency.

With 10-100x the performance at 1/3 the cost compared to legacy infrastructure, SingleStoreDB delivers the speed, scale and agility in one powerfully simple, cloud-native, relational database, helping innovative Fintechs in every segment to drive fast applications and analytics in real time.

To learn more about SingleStoreDB applications and benefits for Fintechs, get our new eBook “Powering Data-Driven Innovation in Fintech: Four Customer Examples.” Follow @SingleStoreDB on Twitter to keep up with all of our latest news.

And try SingleStore for free.